David @ Tokyo

Perspective from Japan on whaling and whale meat, a spot of gourmet news, and monthly updates of whale meat stockpile statistics5/06/2010

Whale and tuna inventory levels

I had just posted pictures of the minke whale dishes that we'd eaten at a local restaurant in the very post that one of these Anonymous comments came to, so the comments struck me as being quite bemusing. The prior comment had been in response to the completely unrelated story I posted about Greenpeace Japan's allegations of embezzlement by whaling crew being rejected by a panel of 11 randomly selected citizens (confirming the prosecutor's decision not to lay charges due to lack of suspicion). It was as if the Anonymous poster were an anti-whaling Greenpeace fan, desperate to have something to cheer about...

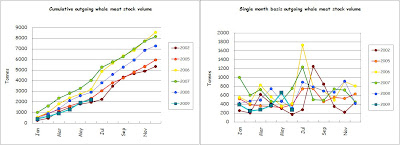

Anyway, one thing I mentioned in the comments was that a Sankei article I saw previously had alluded to levels of bluefin tuna inventory being relatively high despite feared supply shortages, due to the bad economic conditions in Japan. As of the article dated March, there was around 20,000 tons of bluefin tuna in frozen storage, apparently enough to last for a year.

There's a similar situation with whale, which is also regarded as an expensive foodstuff, what with the limitations on supply due to the commercial whaling "moratorium".

I had hoped to find the details of these bluefin tuna inventory figures but the MAFF statistics that I refer to for the whale data doesn't break tuna down into bluefin tuna versus others, unfortunately.

Nonetheless, I did extract the overall tuna figures for 2008 and 2009 to compare with the whale inventory statistics over the same period. The period chosen was purely for convenience - it takes time to go back through the data and pull the necessary bits out, and this is as far as I've done.

Here's a graph of what I've extracted so far:

It is probably difficult to come up with a meaningful comparison of the data on an incoming/outgoing inventory volume basis, given that the "production" and supply features of whale and tuna products are completely different. Nonetheless I think this graph gives an indication of the reality of frozen whale product inventory versus purely commercially produced frozen tuna inventory.

This reminds me that I should also update the Beef, Pork and Whale Stockpiles graph sometime, too.

Labels: whale meat inventory statistics

10/26/2009

Whale meat inventory update - August 2009

As I alluded to last time, I was unable to put these up sooner as I took a jaunt down to the Philippines. It was smashing - did some snorkeling, scuba diving, swimming, plus enjoyed some local cuisine. Best mangoes I've ever had in my life (don't eat mangoes often, but still they were amazing). More on this another time maybe.

Here's the update:

August Statistics

| Statistic | Volume (tons) |

| Outgoing | 809 |

| Incoming | 1851 |

| Month-end | 5288 |

The figures speak for themselves, it was a busy month with the incoming volume for an August being a record in the history I have on this going back to 2001, and 16% higher than in the prior-year period. The bulk of this seemingly was from the offshore component of the ICR's JAPRN II programme conducted in the western north pacific, which drew to a close at the end of July. Presumably it wasn't until August that by-product meat from this programme hit storage facilities. The ICR press release noted that bad weather hindered the programme this year in the northern sectors of the research area, and as a result only 43 minke whales were taken versus a planned sample size of 100, however for Sei (100) and Bryde's (50) whales, the planned number of whales were caught. Only 1 sperm whale was caught from the 10 permitted.

This additional product, while reflected in the inventory figures, will likely not be going on sale until November, judging by the sequence of events last year. The ICR will probably put out another release shortly, giving a break down of the by-products that they will be putting on sale.

Meanwhile, the outgoing volume figure was also the most for an August since 2002, however only 3% higher than the August 2008 figure. The July 2009 figure had also been the lowest in 5 years, so a somewhat stronger figure in August was not so unexpected.

On a net basis, total inventory was boosted up to 5288 tons, the bulk of which is held in Tokyo storage facilities. The last time inventory was so high was back in the summer of 2006, however in that year inventory peaked in April at a much higher level, just short of 6000 tons. As for August 2009, the outgoing figure was a 25% increase versus the prior month, and again 31% higher than the same time a year ago. While demand for whale products (as indicated through the outgoing volume figures) appears softer this year than prior to the global economic crisis, on the supply side the amount of incoming volume has actually been greater in 2009 than any year except the bumper 2006 year, which is also contributing to the increasing inventory levels.

This situation of relatively high inventory levels is not likely to change over the next few months, due to the additional 1500 tons of Icelandic fin whale products reportedly set for import into Japan. The exact timing of the related transactions does not seem to be clear yet however.

Top Regions

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 3,475 | 2,512 | +963 |

| Ishinomaki | 394 | 261 | +133 |

| Hakodate | 392 | 394 | -2 |

| Shimonoseki | 274 | 339 | -65 |

| Funabashi | 257 | 273 | -16 |

| Nagasaki | 172 | 127 | +45 |

| Sasebo | 79 | - | - |

The bulk of the incoming and outgoing volume for the month appears to have occurred in Tokyo storage facilities, with a net 963 ton gain.

Outgoing stock (cumulative)

Incoming stock (cumulative)

Monthly volumes

Annual volumes

Labels: whale meat inventory statistics, whale meat market, whale meat trade

10/03/2009

Whale meat inventory update - July 2009

These stats came out last month actually, and indeed the August stats are due for release next Friday (October 9th) but I'm not likely to be able to publish those here until some time after that (will be enjoying a long weekend).

Not evident in these statistics, but the word is that Iceland's fin whaling company will be supplying around 1500 tons of fin whale meat products to the Japanese market sometime in the upcoming months. This will be a pretty historical event for the whale market here, as there haven't been any really significant levels of exports for around 2 decades. There is a fairly good chance that this will result in the total inventory level hitting a new peak in recent history. Good news for whale consumers.

July Statistics

| Statistic | Volume (tons) |

| Outgoing | 653 |

| Incoming | 381 |

| Month-end | 4246 |

Both the Outgoing and Incoming volumes were around 73-74% of the same month in the prior year, but the Month-end volume was 131%.

Top Regions

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 2,512 | 2,865 | -353 |

| Hakodate | 394 | 395 | -1 |

| Shimonoseki | 339 | 447 | -108 |

| Funabashi | 273 | 281 | -8 |

| Ishinomaki | 261 | 185 | +76 |

| Nagasaki | 127 | 107 | +20 |

| Kawasaki | 76 | - | - |

Sasebo dropped out of the top 7 in July, with Kawasaki's extra stocks bringing it up into 7th place.

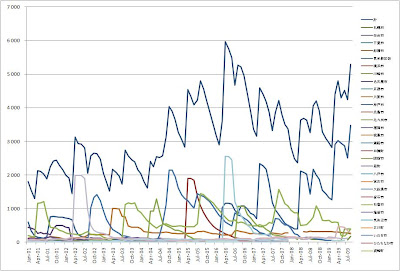

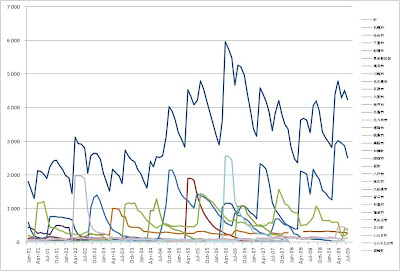

The graph below shows the total inventory (top line) and the regional breakdown below it for illustrative purposes.

Outgoing stock (cumulative)

Incoming stock (cumulative)

Monthly volumes

Annual volumes

Labels: whale meat inventory statistics, whale meat market, whale meat trade

8/14/2009

Whale meat inventory update - June 2009

Well just after my previous update for the May inventory statistics, I loaded up some prehistoric email software on my 7 year old Fujitsu laptop (upon which the anti-virus software expired 6 years ago) and I suspect I downloaded a virus infected email, as the poor thing would no longer boot up, afterwards. I reckon it's fixable (just need time and the right gears), but I needed a working computer pretty much immediately for working from home (as well as wanting a new computer anyway), and so buy a new one I did.

So this update for June is coming to you from my brand spanking new laptop with brilliant high definition display... although you don't get to enjoy it like I do... but due to having a newer version of Micro$oft Excel available my graphs might look a little different from this month, as I play around with things. (Incidentally, thanks to the wonders of Linux and the Internet I was able to retrieve my old Excel from the now dysfunctional Fujitsu laptop, so not too much stress was involved in bring this to you)

But anyway, enough computer talk - here we go - the June inventory statistics. Just a rough outline for starters; may come back and provide extra detail later if time presents itself next week (and very likely it may)

June 2009 outgoing stock: 267 tons

Back down to subdued levels again in June, after the jump in May. Mind you, from July 7 sales of the latest by-product were to commence at lower prices than last year. Buyers therefore may have been holding off until July. We'll see next month.

June 2009 incoming stock: 493 tons

A bit of a jump here on the incoming side. Most of this inventory apparently came into Hakodate storage facilities - see below.

June 2009 end-of-month inventories: 4,518 tons

I'm expecting a reasonable drop in this figure in July - with the JARPA II by-product sales ongoing throughout most of the month. As was the case with May, approximately half of this figure was not for sale as of June.

June 2009 top inventory regions

The table below shows whale inventory movements in the leading inventory regions.

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 2,865 | 2,942 | -77 |

| Shimonoseki | 447 | 458 | -11 |

| Hakodate | 395 | 44 | +351 |

| Funabashi | 281 | 292 | -11 |

| Ishinomaki | 185 | 196 | -11 |

| Nagasaki | 107 | 104 | +3 |

| Sasebo | 53 | 43 | +10 |

There you go - Hakodate the big mover knocking Funabashi out of 3rd place. Not sure what this meat could be though - need to look into that.

Perhaps completely unrelated, but of interest was news out of Iceland that more than 60 fin whales had been caught as of a few days ago. Not sure whether related products from the initially caught and processed fin whales could have been shipped to Japan or not already, but I suppose it's a possibility.

Graph: Inventory ratio

Just when I thought the spike had ended last month, again this month turns out to be rather weak indeed. July and August will likely turn around though, with the JARPA II by-product sales noted above taking place across these next two months of summer.

Graph: Annual volumes

Graph: Monthly volumes

Graph: Outgoing stock (cumulative)

Graph: Incoming stock (cumulative)

Graph: Regional whale meat inventories

That's it for now - see you with more details next week maybe.

Labels: whale meat inventory statistics

7/11/2009

Whale meat inventory update - May 2009

Through the first 4 months of 2009, outgoing inventory volumes were the lowest they have been in some years. Although inventory was at relatively low levels, things were looking distinctively sluggish with just 1287 tons recorded leaving storage facilities up until the end of April.

Meanwhile incoming inventory volumes have been keeping pace with more recent years - roughly between the volumes seen in 2007 and 2008 (although no where near the volumes recorded in 2006).

May sees somewhat of a turnaround as I'll introduce below, and an announcement from the ICR of reduced prices for whale meat by-products from the JARPA II programme may provide a boost, but with both the global and local Japanese economic recoveries looking shaky in recent weeks, one expects that 2009 will turn out to be a relatively poor year for whale meat demand.

May 2009 outgoing stock: 654 tons

The 654 tons of outgoing inventory itself is very high for a May month. The statistics released record this as 141% of the volume for the same month in the prior year. Additionally, figures dating back to 2001 show this as actually being the top May on record. I suspect there may be a bit of "catch-up" here due the recent low outgoing volumes.

On a cumulative basis, at the end of May 2009, the year to date outgoing inventory volume recorded comes to 1,941 tons, roughly the same level as 2005 (the year prior to the first year of JARPA II and the associated increase in whale meat availability).

May 2009 incoming stock: 146 tons

The 146 tons of incoming volume is a drop from March and April which saw influxes of whale meat into Tokyo and Shimonoseki storage facilities. Nothing spectacular for a typical May.

May 2009 end-of-month inventories: 4,292 tons

A large net decrease in inventory during May, but versus the time in 2008, inventories were approximately 17% larger.

The ICR announcement notes that of 2,655 tons of research programme whale meat by-product from the recent JARPA II cruise, 2,221.5 tons are to be made available to general markets from July 7 through August 10. As such, more than half of the inventory held at the end of May can be accounted for by new product that was not yet available for consumers.

Note also, that the 2009 JARPA II by-product volume of 2,655 tons dwarfs the volume from 2008 of 1982.5 tons, so relatively one would expect inventory levels to be greater at this time in 2009 than in 2008.

May 2009 top inventory regions

The table below shows whale inventory movements in the leading inventory regions.

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 2,942 | 3,023 | -81 |

| Shimonoseki | 458 | 463 | -5 |

| Funabashi | 292 | 304 | -12 |

| Ishinomaki | 196 | 592 | -396 |

| Nagasaki | 104 | 117 | -13 |

| Hakodate | 44 | 45 | -1 |

| Sasebo | 43 | 52 | -9 |

Ishinomaki was the big mover in May, shipping 396 tons out of storage facilities. The other interesting thing in May was that for exactly the first time in a year, Funabashi inventory dipped below 300 tons. Funabashi was the only stockpile region where inventory levels had been holding relatively static, just above 300 tons. I suspect that there was something special about these 300 or so tons of product, but this sort of detail is unlikely to be elucidated through any readily available sources such as news media.

Graph: Inventory ratio

The spike has ended for now.

The spike has ended for now.Graph: Annual volumes

Graph: Monthly volumes

Graph: Outgoing stock (cumulative)

Graph: Incoming stock (cumulative)

Graph: Regional whale meat inventories

June figures are set for release on August 10.

Labels: whale meat inventory statistics

6/21/2009

Whale meat inventory update - April 2009

Not much time again at the moment, will maybe add more commentary later.

April 2009 outgoing stock: 369 tons

April 2009 incoming stock: 767 tons

April 2009 end-of-month inventories: 4,800 tons

April 2009 top inventory regions

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 3,023 | 2,912 | +111 |

| Ishinomaki | 592 | 601 | -9 |

| Shimonoseki | 463 | 123 | +340 |

| Funabashi | 304 | 310 | -6 |

| Nagasaki | 117 | 134 | -17 |

| Sasebo | 52 | 48 | +4 |

| Hakodate | 45 | ? | n/a |

| Kushiro | ? | 48 | n/a |

Graph: Inventory ratio

Graph: Annual volumes

Graph: Monthly volumes

Graph: Outgoing stock (cumulative)

Graph: Incoming stock (cumulative)

Graph: Regional whale meat inventories

Labels: whale meat inventory statistics

5/31/2009

Whale meat inventory update - March 2009

*** UPDATED 2009/05/31***

Tena koe everyone, again struggling to make time at the moment but here's a brief update for the March figures that were released last Friday.

March was again not a good month if you are looking for big decreases in existing inventory, but if you are an anti-whaling propaganda merchant then it's time to put your hat on and go to town as the inventory volumes will be peaking around about now or with the April figures.

March 2009 outgoing stock: 278 tons

Again - another low figure for outgoing inventory. Just 51% compared with the prior year month.

March 2009 incoming stock: 1,861 tons

This month is clearly unusual, and the regional stockpile breakdown figures included in the Ministry's release show that Tokyo's inventory increased by a net of 1,645 tons for the month. Didn't see it in the media (may have missed it), but the JARPA II fleet's supply vessel appears to have returned to Japan during the month of March, and unloaded perhaps as much as 1,750 tons of whale meat by-product in facilities in the Tokyo region. As always, note that this new inventory does get made available for sale on the market until early summer however (and some of it gets set aside for public purposes).

March 2009 end-of-month inventories: 4,402 tons

A 56% increase from February indicates that the previous month's inventory level of 2,819 tons is likely to be a low for 2009.

* * *

Will look to get back to this with graphs etc if the time presents itself - maybe on the weekend.

* * *

---- UPDATE 2009/05/31 ----

Almost June, and the April figures will be out in on the 10th, but here are some of my regular items.

March 2009 top inventory regions

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 2,912 | 1,267 | +1,645 |

| Ishinomaki | 601 | 590 | +11 |

| Funabashi | 310 | 318 | -8 |

| Nagasaki | 134 | 152 | -18 |

| Shimonoseki | 123 | 121 | +2 |

| Kushiro | 48 | 53 | -5 |

| Sasebo | 48 | 57 | -9 |

Graph: Inventory ratio

The inventory ratio spike continued in March.

The inventory ratio spike continued in March. Graph: Annual volumes

Graph: Monthly volumes

Graph: Outgoing stock (cumulative)

This year sees outgoing inventory figures the weakest they have been in some years.

This year sees outgoing inventory figures the weakest they have been in some years. Graph: Incoming stock (cumulative)

On the incoming stock side 2009 is shaping up to be second only to 2006, but we'll have a better idea once the April figures are released.

On the incoming stock side 2009 is shaping up to be second only to 2006, but we'll have a better idea once the April figures are released.Graph: Regional whale meat inventories

Around half of the inventory shown here in the Tokyo figures was not for sale as of March month-end, and won't be until sometime in June or July.

Around half of the inventory shown here in the Tokyo figures was not for sale as of March month-end, and won't be until sometime in June or July.Funabashi's seemingly static inventory levels remain a mystery.

Labels: whale meat inventory statistics

4/18/2009

Whale meat inventory update - February 2009

February 2009 outgoing stock: 249 tons

Another measly month on the outgoing stock front, just 249 tons leaving storage. We have to go back to 2004 or thereabouts to find such a weak figure. The figure here is just 50% of the volume for the prior year month.

That said, large fluctuations versus the prior year month are common occurrences for whale, and indeed we may see a relatively large outgoing stock figure for March when those figures are announced.

The weak outgoing figures (and see total inventory below as well) have seen the whale inventory ratio index increase in the past couple of months.

Will February be just another spike, or is there a short term weakness in demand for relatively expensive whale products due to these times of economic turmoil?

February 2009 incoming stock: 101 tons

This figure is fairly typical for a February, although slightly lower (81%) than for the prior year period.

The JARPA II fleet returned to port in Shimonoseki some days ago; the stock offloaded there will not appear in the statistics until the April figures are released around June 10.

February 2009 end-of-month inventories: 2,819 tons

Below 3,000 tons again for February (and subsequent March figures should mark the low point for inventory in 2009), but a slight increase versus the same period in the prior year.

Inventories were 2% higher than at the end of February 2008, but relatively speaking are at quite low levels.

February 2009 top inventory regions

The table below shows whale inventory movements in the leading inventory regions.

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 1,267 | 1,323 | -56 |

| Ishinomaki | 590 | 657 | -67 |

| Funabashi | 318 | 320 | -2 |

| Nagasaki | 152 | 162 | -10 |

| Shimonoseki | 121 | 122 | -1 |

| Sasebo | 57 | ? | n/a |

| Kushiro | 53 | 58 | -5 |

| Hakodate | ? | 53 | n/a |

No remarkable changes but we see that Sasebo (in the Kyushu region, where whale is said to be most popular in Japan) pops into the list this month, while Hakodate drops out of the top 7.

Graph: Annual volumes

Two months gone, but it looks like a slow start to 2009.

Two months gone, but it looks like a slow start to 2009.Graph: Monthly volumes

But then there is a relatively low level of inventory at the present time.

But then there is a relatively low level of inventory at the present time.Graph: Outgoing stock (cumulative)

Rejigged this graph from 2008 a little, and might change the colours for the 2009 line as time goes by. In any case the slow start to 2009 is clear from this picture.

Rejigged this graph from 2008 a little, and might change the colours for the 2009 line as time goes by. In any case the slow start to 2009 is clear from this picture.Graph: Incoming stock (cumulative)

Just a typical start to 2009 from the incoming stock perspective however.

Just a typical start to 2009 from the incoming stock perspective however.Graph: Regional whale meat inventories

The top blue line is the overall inventory level, and the lines below that are the inventories per region. Tokyo and Ishinomaki are the top two, while Funabashi maintains it's mysterious stock of static whale again this month.

The top blue line is the overall inventory level, and the lines below that are the inventories per region. Tokyo and Ishinomaki are the top two, while Funabashi maintains it's mysterious stock of static whale again this month.March figures are set to be released on the 8th of May, and I'll have another update for you then.

Labels: stockpile figures, whale meat inventory statistics

3/15/2009

Whale meat inventory update - January 2009

Just the basics for starters, and I'll try to catch up with graphs later when time presents itself, but there isn't much to illustrate with only figures for the first month of the year anyway.

January 2009 outgoing stock: 391 tons

Another slow month in the shipments figure, 391 tons recorded as leaving storage. 391 tons is 73% of the volume recorded for the same month in 2008.

A couple of possible factors influencing the low shipment volume spring to mind:

1) The effect of the economic slump that's going on, of course globally but particularly Japan being an export-dependent nation has been hit hard, as it's Yen currency has appreciated substantially over the past several months and demand from abroad has dropped due to problems overseas. With whale being a rare and rather expensive option for consumers, the tough economic times may be seeing whale consumers opt for cheaper options.

2) Overall inventory for whale is (as of January) at relatively low levels compared with recent years, and substantial additional product is not likely to be available until the JARPA II by-product goes on sale in summer. Dealers may be pacing their sales so as to ensure supply is available until that time. Additionally in January, uncertainty remains about the level of additional product to become available as a result of the JARPA II programme, due to further (not to mention exceedingly dangerous) harassment from the sheep of Paul Watson's anti-whaling personality cult group, "Sea Shepherd".

January 2009 incoming stock: 262 tons

A relatively large month for incoming stock however, 262 tons being 218% of the corresponding January 2008 figure.

January 2009 end-of-month inventories: 2,967 tons

Overall, inventories fell below 3,000 tons as of the end of January, a 4% decrease on the end of the previous month, and 5% lower than at the same time a year earlier.

Whale is in relatively short supply.

January 2009 top inventory regions

The table below shows the movements in whale inventory in the leading inventory regions.

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 1,323 | 1,451 | -128 |

| Ishinomaki | 657 | 643 | +14 |

| Funabashi | 320 | 320 | 0 |

| Nagasaki | 162 | 114 | +48 |

| Shimonoseki | 122 | 125 | -3 |

| Kushiro | 58 | 61 | -3 |

| Hakodate | 53 | ? | n/a |

| Kawasaki | ? | 64 | n/a |

Tokyo remains firmly in the number 1 spot, showing the largest decrease, whereas 2nd place Ishinomaki recorded an increase, as well as the top consumption region of Nagasaki. Funabashi inventories again mysteriously remain largely static. At the bottom end of the table, Kawasaki drops out of the top 7 (decreasing at least 11 tons to come in below new 7th place Hakodate).

That's your update for January 2009 figures

The February 2009 figures are due for release on the 10th of April at 11:00AM

Labels: stockpile figures, whale meat inventory statistics

2/15/2009

Whale meat inventory ratio index

Over the new year's holiday (unfortunately it takes me until the middle of February to get around to writing about it) I enjoyed a relaxing time down in Shikoku.

Over the new year's holiday (unfortunately it takes me until the middle of February to get around to writing about it) I enjoyed a relaxing time down in Shikoku.Before I even start, I'll mention a complete aside to this - Kochi prefecture which lies on the South-Eastern side of Shikoku facing the Pacific was in the past an area where whaling apparently took off to quite a degree. And the Shikoku airport through which I transited contains souvenirs from the four prefectures of Shikoku island for travellers to conveniently purchase before they depart for wherever they came from or may be going. Getting to the point of this aside, a souvenir shop at the airport there stocks 3 types of whale foodstuff souvenirs from Kochi prefecture. I sampled the jerky offering (pictured to the right) on this occasion. It was not bad, but there is a Shimonoseki produced jerky offering that I prefer to it.

Getting back on track... while down in Shikoku I had a wealth of relaxation time, and with me I took a copy of Toyo Keizai's 2009 preview edition. (Toyo Keizai is a prominent economics magazine here, and when the financial world and subsequently the world economy collapses this stuff becomes especially interesting). Inside the magazine was a special section covering various economic indicators that currency strategists etc. spend their days pouring over for clues about where the economy is headed and where it has been.

Amongst all of these indicators was mention of "inventory ratio indices", and I thought about the application of this to the whale meat inventory statistics that I present each month.

The Nikkei newspaper's website had a useful definition / description of this particular economic indicator here; below is my translation (there are English descriptions elsewhere for sure though):

Inventory ratio index (在庫率指数)As for whale, our basic product of interest, at least with respect to the current Japanese market, it is not the case that inventory is a result of "production" per se, as currently the main source of inventory is "by-product" from government sponsored special permit research programmes, in addition to relatively low levels of indirect by-catch and stranding. In all cases, the "production" of whale product is incidental in nature, and thus it does not hold that inventory would increase or decrease in response to economic conditions. Also, strictly speaking, inventories are believed to include volumes of small cetacean products as well as imported products from recently resumed international trade with those nations permitting commercial whaling operations. However dominating the current reality is incidental, non-commercial "production". Recall also that the bulk of the products available hit the official inventory statistics at two times in the year, coinciding with the return of the pelagic research vessels to Japan.

Industrial production inventory volumes divided by shipment volumes.

Inventory is a result of production, and lags behind economic conditions. Further, inventory increases occur not only in the case of "products not selling", but also when "companies increase production". As such, economic conditions can not be judged by [inventory figures] alone. For that reason, inventory ratio indexes were created by combining inventory and shipment data.

During times of economic expansion, as shipments increase more than increases in inventory, the inventory ratio index decreases, and conversely during times of economic contraction it increases.

Often moves in advance of economic conditions.

From the other side of the equation, the rational explanation for shipments to increase is due to increased consumption. The bulk of consumption is "commercial" in nature, although again, a fraction of the special permit by-product is set aside for "public purposes".

In this context I calculated basic inventory ratios for the figures available.

As seen in the graph below, the ratio is all over the place, and although one can look at specific months that stand out, overall it seems sensible to average the ratio over a series of months, using a simple moving average. So, also shown in the graph below is a 12-month SMA in green.

As we can see, back prior to mid 2006, there were some "weak" months where the ratio was well over 12. At a glance it appears that these months occur around the time after the JARPA by-product has hit the inventory figures, but before that by-product has gone on sale. That is, the high value of the ratio occurs in part due to the existing in inventory that isn't yet available for sale. One might attempt to try to correct for this, but well, I don't have time :)

In any case it's clear that the ratio by itself is quite spikey.

Averaged over 12 months (using MS Excel's default calculation method) we can see that the ratio has been hovering just above 6 since around July 2007. Given that whale meat "production" tends to occur at two times during the year, a ratio of 6 (plus a bit) seems to indicate good rates of consumption given current levels of supply.

Labels: stockpile figures, whale meat inventory statistics

Whale meat inventory update - December 2008

Obviously this wraps up the 2008 year so we can make a few observations versus previous years.

December 2008 outgoing stock: 415 tons

After the relatively large outgoing stock volume in November, December 2008 turned out to be a relative "fizzer", although 415 tons was only down 3% on the same month in December 2007.

December 2008 incoming stock: 229 tons

Also relatively low incoming stock volumes, here down 28% on the same month in the previous year. December is always low though.

December 2008 end-of-month inventories: 3,096 tons

Overall, volumes dropped just under 200 tons, or 6% versus the previous month end, and as of the year end volumes were almost 300 tons less than as of December-end 2007. In fact we have to go back to December 2003 to find a year-end with inventories running lower than this. That year they were significantly lower however, at around 2,150 tons.

December 2008 top inventory regions

The summary of movements in the top stockpile regions:

| Region | Stockpile size at month end | Stockpile size at previous month end | Movement |

| Tokyo city wards | 1,451 | 1,551 | -100 |

| Ishinomaki | 643 | 648 | -5 |

| Funabashi | 320 | 313 | +7 |

| Shimonoseki | 125 | 131 | -6 |

| Nagasaki | 114 | 135 | -21 |

| Kawasaki | 64 | 74 | -10 |

| Kushiro | 61 | 83 | -22 |

Not much happened, with Tokyo the only region showing 3-digit movement in tons.

Funabashi is still mysteriously static.

Graph: Annual volumes

A total of 7.274 tons recorded as leaving storage in 2008, versus incoming volumes of 7,237 tons. The second straight year of outgoing stock shipments outstripping incoming volumes, but with supply (from mainly non-commercial research programmes) on the decrease, the overall volumes were lower than the previous two years.

A total of 7.274 tons recorded as leaving storage in 2008, versus incoming volumes of 7,237 tons. The second straight year of outgoing stock shipments outstripping incoming volumes, but with supply (from mainly non-commercial research programmes) on the decrease, the overall volumes were lower than the previous two years.Graph: Monthly volumes

With inventory at lower levels at the same time in the previous year, the next question is how low stocks will go in early 2009, prior to the next significant incoming stock hitting the statistics around April.

With inventory at lower levels at the same time in the previous year, the next question is how low stocks will go in early 2009, prior to the next significant incoming stock hitting the statistics around April.Graph: Outgoing stock (cumulative)

Graph: Incoming stock (cumulative)

Graph: Regional whale meat inventories

The January 2009 figures are scheduled for release on the 10th of March.

Labels: stockpile figures, whale meat inventory statistics

Archives

June 2004 July 2004 August 2004 September 2004 October 2004 November 2004 December 2004 January 2005 March 2005 April 2005 May 2005 June 2005 July 2005 August 2005 September 2005 October 2005 November 2005 December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 June 2006 July 2006 August 2006 September 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 July 2007 August 2007 September 2007 October 2007 November 2007 December 2007 January 2008 February 2008 April 2008 May 2008 June 2008 July 2008 August 2008 September 2008 October 2008 November 2008 December 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 January 2010 February 2010 April 2010 May 2010 June 2010 July 2010 August 2010 September 2010 February 2011 March 2011 May 2013 June 2013